Donate Now!

A gift made by cash, check or credit card can be put to work immediately to offset expenses of providing medical care to the uninsured.

Your gift will be acknowledged with our thanks and a receipt for tax purposes. Most contributions are fully tax deductible.

Please make checks payable to Keystone Health and send them to:

Development

Keystone Health

22 St. Paul Drive Suite 200

Chambersburg, PA 17201

To make a gift by credit card call the office at (717) 709-7900.

Or feel free to use our upcoming online donation area.

Our Mission

Keystone Health eliminates barriers to health care by providing affordable, accessible and compassionate medical, dental and support services to men, women and children of all ages, races and economic backgrounds.

What is a Community Health Center?

Keystone Rural Health Center (our corporate name) is a not-for-profit, 501©3 Community Health Center and a Federally Qualified Health Center.

Community Health Centers are programs of the federal Bureau of Primary Health Care which provide health care regardless of a person’s ability to pay and even if he or she has no health insurance.

Health Centers are characterized by five essential elements that make them different from other healthcare providers:

- They must be located in or serve a high-need community known as a “medically underserved area”

- They must provide a full range of primary care services, as well as supportive services such as translation, that promote access to health care.

- Their services must be available to all residents of their service areas, with fees adjusted according to patients’ ability to pay.

- They must be governed by a Board of Directors composed of community members, most of whom are patients of the Center.

- They must meet other performance and accountability requirements regarding their clinical, financial and administrative operations.

Ways of Giving

Outright Gifts

A gift made by cash, check or credit card can be put to work immediately to offset expenses of providing medical care to the uninsured.

Your gift will be acknowledged with our thanks and a receipt for tax purposes. Most contributions are fully tax deductible.

Life Insurance

You can give a gift to Keystone Rural Health Center by naming us as the owner or beneficiary of a life insurance policy. You may give either a new or existing policy. You may be entitled to an immediate income tax deduction when you transfer complete ownership of the policy to Keystone Rural Health Center during your lifetime.

Real Estate

One of your most valued possessions, your home, can become a valued gift to Keystone Rural Health Center even while you are still living in it, even if you want your spouse or other person to live there for life. This arrangement is called a retained life estate.

Commercial, residential or other real estate assets can be given to Keystone Rural Health Center. By donating real estate instead of selling it, you also may save on state and local transfer taxes.

Corporate Gifts

If your company or private foundation has philanthropic interests and would like to make an investment in one of Keystone Rural Health Center’s programs, please call our office at (717) 709-7900.

Wills, Bequests and Trusts

A bequest is the naming of a charitable organization, such as Keystone Rural Health Center, in your will. You can make provisions under a will in various ways. For example, you may specify assets, a percentage of your estate or a specific amount of money to be paid to Keystone Rural Health Center.

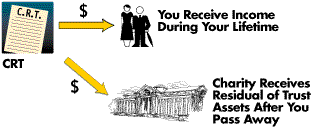

A Charitable Uni-Trust is more commonly known as a Charitable Remainder Trust (CRT). This allows you to reduce estate taxes, eliminate capital gains, claim an income tax deduction, and benefit an organization instead of the IRS.

Stocks and Securities

Gifts of appreciated securities, mutual fund shares, or certain other types of appreciated property can be a way for donors to support Keystone Rural Health Center.

You may receive tax benefits in addition to a charitable income tax deduction. Your cost is the original price of the security, while the value of your gift to the Center is the fully appreciated value of the security. Keystone Rural Health Center recommends that you discuss your plans with your tax advisor.

Retirement Plans

By giving retirement plan assets – such as IRA’s and Keogh plans, employer sponsored pension and profit-sharing plans – to Keystone Rural Health Center, donors can make a substantial gift to the Center at very low cost and reap significant tax savings. Donors can name Keystone Rural Health Center as the beneficiary of planned assets after the surviving spouse’s death.